Financial Accounting Write for us

Financial accounting is the systematic procedure of recording, classifying, summarizing, analyzing, and reporting business transactions. The primary objective is to reveal the profits and losses of a business. Financial accounting provides a true and fair evaluation of a business. It, therefore, safeguards the interests of stakeholders.

Financial accounting includes bookkeeping, classification, and interpretation of business transactions. The profitability and financial position of a firm are ascertained. It represents revenue, expenses, assets, liabilities, and equity in respective financial statements, i.e., income statements, cash flow statements, and balance sheets.

Financial Accountant’s Role

A financial accountant may have job opportunities in public and private sectors. The financial accountant’s duties vary from those of a general accountant, who works for himself or herself rather than for a firm or organization directly.

Financial accounting uses a set of accounting standards that are developed. The selection of accounting standards to be used by a financial accountant depends upon the regulatory and reporting requirements facing the company.

This information serves as the basis for many critical decisions. The data is used accordingly by managers, shareholders, creditors, lenders, and investors.

What Is Financial Accounting?

Financial accounting is a specific branch of accounting involving a process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over some time. These transactions are summarized in preparing financial statements—including the balance sheet, income statement, and cash flow statement—that record a company’s operating performance over a specified period.

Work opportunities for a financial accountant can be found in the public and private sectors. A financial accountant’s duties may differ from those of a general accountant, who works for themself rather than directly for a company or an organization.

How Financial Accounting Works

Financial accounting utilizes a series of established principles. Which accounting principles are used depends on the regulatory and reporting requirements of the business.

Fundamentals of Financial Accounting

Financial accounting is simply the bookkeeping and interpretation of transactions. It is carried out to gauge corporate performance and profitability. The regulatory bodies have stated some basic principles to standardize the process. In the US, companies follow the guidelines of GAAP.

All financial transactions revolve around five essential components, i.e., assets, liabilities, income, expenses, and equity. Also, every financial transaction has two equal aspects. For example, if cash is withdrawn from a bank in the company’s book under the double-entry system, cash and the bank would be affected. Under the double-entry system, we call these two aspects; debit and credit. Debit is either the increase in assets and expenses or the decrease in liabilities and income. Credit is either the increase in liabilities and income or the decrease in assets and expenses.

Financial Accounting Principles

As financial accounting solely prepare for disclosing a company’s financial information, the company’s statements and reports should be valid and credible. Companies follow specific rules charted under the “Generally Accepted Accounting Principles,” abbreviated as GAAP.

GAAP covers basic accounting principles, including the going concern principle, whole disclosure concept, accrual concept, matching, cost, consistency, economic entity, materiality, period, revenue recognition, and monetary unit. GAAP ensures accurate and reliable reports. However, GAAP doesn’t always remain the same. Instead, it constantly update base on the complexities arising in accounting.

Types of Financial Accounting

A company can record its transactions in two ways.

Cash Accounting: The GAAP recommends this method. This kind of financial accounting considers cash transactions. Thus, each transaction has a debit and credit entry.

Accrual Accounting: Most corporations prefer this method to record cash and non-cash business transactions. This method emphasizes the documentation of trades as and when they occur, irrespective of monetary exchange.

Financial Accounting Statements

- Every investor should go through the following four financial statements of a company.

- Income Statement: The income statement aims to find the company’s net income for the year. Accountants take all accounting transactions (including non-cash ones) and do a “revenue–expense” analysis to determine the year’s profit.

- Balance Sheet: The Balance Sheet is based on the following equation –

- Assets = Liabilities + Shareholders’ Equity.

- It states that a business entity possesses and owes.

Shareholders’ Equity Statement: It is a statement that includes shareholders’ equity, retained earnings, reserves, and other stock-related items. It is an indicator of the changes in the ownership interest of the stakeholders.

Cash Flow Statement: The cash flow statement combines three statements – cash flow from operating activities, cash flow from financing activities, and cash flow from investing activities.

How to Submit Your Articles

To Write for Us, you can send correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times – Bookkeeping Write for Us

Search Related Terms to Financial Accounting Write for Us

Search Related Terms to Financial Accounting Write for Us

- accounting

- wave accounting

- accounting equation

- forensic accounting

- accounting software

- accounting jobs

- big 4 accounting firms

- accrual accounting

- double entry accounting

- accounting jobs near me

- what is accounting

- accounting firm

- remote accounting jobs

- financial accounting

- accounting firms

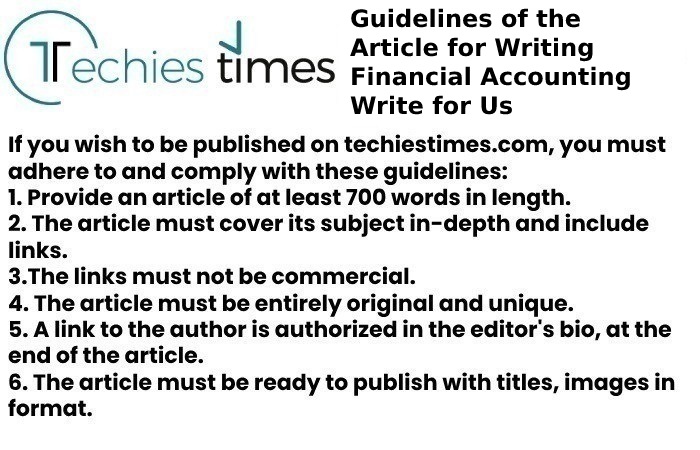

Guidelines of the Article for Writing Financial Accounting Write for Us

Search Related Terms for Financial Accounting Write for Us

- Accounting basics

- Accounting principles

- Accounting standards

- Financial statements

- Balance sheet

- Income statement

- Statement of cash flows

- Accounting ratios

- Financial analysis

- Tax accounting

- Auditing

- Accounting software

- Accounting education