Forensic Accounting Write for us

Forensic Accounting is nothing but an accountant in a foreign. That accountant works in many fields with good quality and good looking. Forensic Accountants need to have an interest in and the skill to develop accounting, auditing, financial and investigative skills to identify, document, and analyze information frequently from hostile or opposing parties that are required to form and support an opinion.

The Forensic Accountant must have the confidence and ability to respond immediately to questions raised in court. Further, and potentially even more important than knowing the answers, the Forensic Accountant must be able to communicate often highly technical and complex financial information in a manner that the court will understand.

What is Forensic Accounting?

Forensic accountants combine their accounting knowledge with fact-finding skills in various hearing support and investigative accounting settings. Forensic accountants employ public accounting firms’ forensic accounting divisions; consulting firms specifying in risk consulting and forensic accounting services; or lawyers, law application agencies, insurance companies, government organizations, or financial institutions. Due to sensitive awareness and growing intolerance of fraud, the demand for forensic accountants is rapidly increasing.

Where are the Forensic Accounting Jobs?

Most forensic accounting positions require at least 1-3 years of accounting experience. Many forensic accountants obtain this experience by being occupied as general accountants. Career growth for forensic accountants is based mainly on location, according to PayScale and the Association of Certified Fraud Examiners.

Some states have an exceptionally high demand for accountants, including those specializing in forensics. Utah, for example, has a projected growth rate of more than 30% by 2028. Other states with high growth rates include Tennessee, Colorado, and Nevada. A forensic accounting salary may start at the entry level at $63,000, while upper-level employees could earn $147,000 or more.

You can expect rapid expansion in forensic accounting jobs in the business, finance, legal, and governmental sectors.

The critical areas of work for Forensic Accountants are:

Quantification of Damages and Loss of Profits

Assessing the effect on success, cash flow, income, or value, that a party claims to have suffered or may incur because of either a breach in a contract, personal injury, product responsibility, violations of the Trade Practices Act, or Fair Trading, etc.

The Forensic Accountant may also need to consider the impact of other circumstances on the claimed loss and the degree to which the loss mitigates or could mitigate to determine the loss sustained.

Valuations

Determining the value of stocks, businesses, companies, intangibles, etc., in argument, lost, or ruined. The Forensic Accountant must review information as a financial analyst and an investigating accountant, make appropriate adjustments, and apply a generally accepted or arguable methodology to determine the value.

Government Agencies

Local law enforcement and government agencies such as the FBI, CIA, and IRS are seeing an upswing in demand for forensic accounting services. At these agencies, you would investigate criminal activity, terrorism, and other threats.

You would also build financial profiles of individuals and organizations under investigation and gather evidence as part of the discovery process. In this role, you may also call on to testify as an expert witness in court proceedings.

Corporate Security and Risk Management

Risk management and corporate security are other fields experiencing substantial growth. Major companies want to protect their assets by ensuring that their financial procedures comply with regulations.

In this position, you would work to protect a firm’s resources and analyze risk levels by keeping a close watch on their financials. You would also be responsible for monitoring changes in finance law and other factors that affect corporate accounting.

Why Pursue a Career in Forensic Accounting?

Companies are looking to lower their financial risk, and governments are cracking down on fraud and financial crimes. That’s where you come in.

The private and public sectors need forensic accountants to perform these jobs, and the industry’s growth means there’s room for advancement. The investigative element of forensic accounting also makes it an exciting and gratifying career. More benefits you can expect from this career include:

Career Mobility

High growth expects due to tightening financial regulations and increasing demand from companies for financial risk management. Expect many new job openings in the coming years as these needs continue to rise.

Personal Satisfaction

Forensic accounting dynamically blends data, analytics, investigative skills, and sometimes criminal justice. This can be a gratifying career for someone with an innate sense of intuition and curiosity.

How to Submit Your Articles

To Write for Us, you can correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times Blog – Forensic Accounting Write for Us

What We Look for

Successful guest post contributions should be comprehensive, data-driven, engaging, and educational. To increase your chances of receiving publication on our blog, ensure that your donation,

- It is a relevant, well-researched post (preferably 1000+ words) with actionable tips.

- It is 100% original and unpublished. We will not republish anything that publishes elsewhere.

- Only includes claims backed by links to credible research or case studies. Avoid citing our competitors and using any irrelevant promotional links to websites.

- Includes examples and relevant images to illustrate your point. Avoid using stock photos that don’t add any value to the copy. Use Create to picture data, information, processes, ideas, and frameworks.

- Includes subheadings, bullet points, and shorter paragraphs, making the article more explicit.

Topics We Cover

Most of our audience involves individuals and teams from different executive departments looking for tips, best does, and guides on working and collaborating visually. As we aim to build a trustworthy library of information and visions that they can refer to improve and update their workflows, we only accept explicit, compelling content falling into the following categories,

- Visual collaboration

- Visual project management

- Business and technical diagramming

- Visual problem-solving

- Visual creativity and communication

- Data imagining

- Design thinking

Business process showing

Please refer to the current posts on our blog to appreciate and classify more topics, content layouts, language, and tones that we prefer.

The Benefits of Forensic Accounting

Exposure to a vast Spectators

The blog gets 100,000+ visitors per month and is swelling progressively. Our monthly newsletter includes all high-quality articles, bringing your piece to a broader audience who will read and reshare your content.

Social Media Experience

We maintain an active presence on social nets like Facebook, Twitter, LinkedIn, and Pinterest. All your articles will share via these networks for additional contact.

Payments

Satisfy note that we will not pay for your training. If you’re an expert writer and think you can create excellent essays for us, contact us with some previous writing samples.

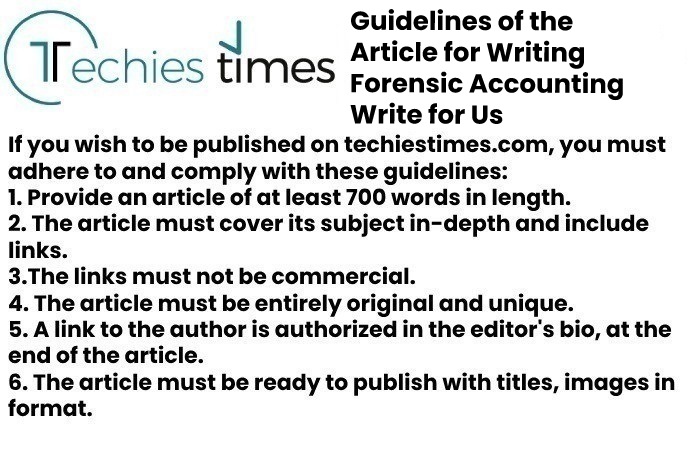

Guidelines of the Article for Writing Forensic Accounting Write for Us

You can send your email to Contact@techiestimes.com

You can send your email to Contact@techiestimes.com

Search Terms Related for Forensic Accounting Write for us

- forensic accounting blog post ideas

- forensic accounting guest post ideas

- forensic accounting topics to write about

- forensic accounting writing prompts

- forensic accounting blog post topics

- forensic accounting guest post topics

- forensic accounting writing ideas

- forensic accounting content ideas

- forensic accounting blog post inspiration

Here are some specific examples of topics that you could write about for a forensic accounting blog or guest post:

- What is forensic accounting?

- How does forensic accounting work?

- Common types of forensic accounting investigations

- The Role of forensic accountants in fraud detection and Prevention

- The latest trends in forensic accounting

- How to Become a forensic accountant