Income Tax Write for us

Income tax write for us: Income tax is a tax on annual earnings for individuals, businesses, and other legal entities. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax.

The federal income tax is the largest source of income for the federal government. All states except for Washington, Texas, Florida, Alaska, Nevada, South Dakota, and Wyoming withhold state income tax in addition to federal income tax. State income tax taxes vary from state to state.

Income Tax Calculation

Income tax calculation can be done manually or using an online computer. The amount of tax that must be paid will be contingent on the tax slab under which you fall. Salaried employees’ income includes basic pay, House Rent Allowance, Transport Allowance, Special Allowance, and other allowances.

However, specific salary components are tax-exempt, like Leave Travel Allowance, reimbursement of telephone bills, etc. If HRA is part of your salary and you reside in a rented house, you can claim an exemption. Apart from these exemptions, there is a standard deduction of up to Rs.50,000.

What is Income Tax?

Income tax is a tax exciting on the annual income made by an individual. The amount of tax paid will depend on how much money you make as income over a financial year. One can continue with Income tax payments, TDS/TCS payments, and Non-TDS/TCS payments online. All taxpayers must fill in the relevant facts to make these payments. The entire process becomes simple and quick.

Who Should Pay Income Tax?

It is mandatory to file ITR for persons If the total gross income is over Rs.3,00,000 in a financial year. This limit exceeds Rs.3,00,000 for senior citizens and Rs.5,00,000 for super senior citizens. The entities listed below must pay taxes and file their income tax returns.

Income Tax Reappearance

Here is all you need to know about how to file ITR online. Before you file your tolls, you will need your Form 16, if by your employer, and any proof of asset. You can compute the tax payable and any refunds for the year. You can download the IT groundwork software from the IT department’s website. Once you have all the forms ready, you can start the Income tax return filing process.

Income Tax Payment Details

Taxpayers can pay direct taxes online by using the e-Payment facility. To avail of the online tax payment facility, taxpayers must have a net-banking account with an authorized bank. The Permanent Account Number (PAN) or Tax Deduction and Collection Number (TAN) will also have to provide for validation.

About Income Tax Department India

A government agency that undertakes direct tax collection in India is the Income Tax Department—all department operations are handled by the Central Board for Direct Taxes (CBDT). Individuals can get details such as international taxation, tax laws, and rules, organizational setup, etc., on the official website of the department.

Income Tax Act

Passed in 1961, the Income Tax Act of India handles all income tax provisions as well as any tax deductions that may be applicable. Since its introduction, there have been many changes to the law because of economic situations and inflation.

Income Tax Rules in India

The legislature enacted the Income Tax Act of 1961 to administer and govern income tax in the country. Still, the Income Tax Rules, 1962, were created to help apply and enforce the law constituted in the Act. Moreover, the Income Tax Rules only read with the Income Tax Act. The Income Tax Rules are within the framework of the Income Tax Act and are not allowed to override its provisions.

How to Submit Your Articles

To Write to Us, you can send correspondence at To Submitting Your Articles for my sites is

Why Write for Techies Times – Income Tax Write for Us

Search Related Terms to Income Tax Write for Us

- income tax

- Milton Friedman’s negative income tax

- negative income tax

- earned income tax credit

- income tax explained

- federal income tax

- income tax accounting

- how to file an income tax return in the USA

- income tax is illegal

- three stooges income tax is sappy

- income tax return

- states with no income tax

- what is income tax

- income tax return filing 2017-18

- income tax course

- income tax preparation training

- corporate income tax

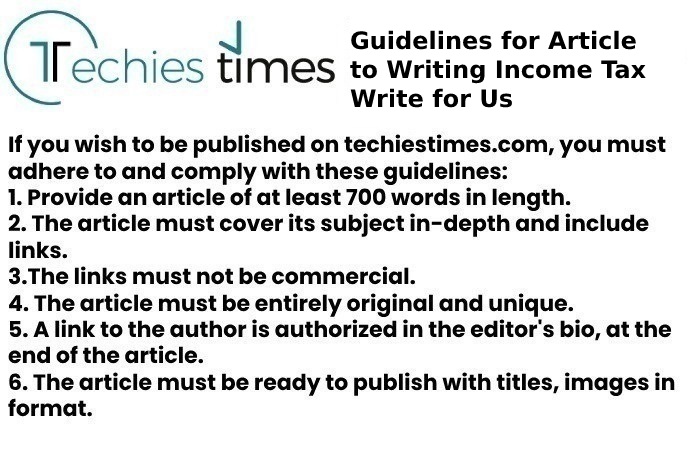

- Guidelines for Article to Writing Payroll Write for Us

Guidelines of the Article – Income Tax Write for Us

You can send your email to contact@techiestimes.com

You can send your email to contact@techiestimes.com